estate tax exclusion amount sunset

Reducing tax brackets permits tax reform to be based upon the current system of. The estate tax due would be zero.

9 Estate Planning Resolutions For The New Year Buckley Law P C

The estate tax exemption is adjusted for inflation every year.

. You can gift up to the exemption amount during life or at death or some combination thereof. Put simply this will only affect you if the total value of your estate exceeds the tax exemption amount. In 2022 the federal estate tax exemption is 12060000 for an individual or.

We arent sure what you will be living on between 2025 and the date of your death but at least no death tax will be payable. The size of the estate tax exemption meant. 2 In addition the 40 maximum gift and estate tax rate is set to increase to 45 in 2026.

In particular for decedents dying and. After that the exemption amount will drop back down to the prior laws 5 million cap which when adjusted for inflation is expected to be about 62 million. Even if you believe that that you may not be affected by the federal estate tax you still need to determine.

The IRS has announced that the exemption for 2019 is 114 million up from 1118 million in 2018. 3969 Tax Assessed Value. Any tax due is.

The lifetime estate exclusion amount also sometimes called the estate tax exemption amount the applicable exclusion amount or the unified credit amount has been. The current estate and gift tax exemption law sunsets in 2025 and the exemption amount will drop back down to the prior laws 5 million cap which when adjusted for inflation. Even then only the value over the exemption threshold is taxable.

The federal estate tax exemption for 2022 is 1206 million. The first 1206 million of your. The federal estate gift and generation-skipping transfer tax exemption amounts are currently set at 1158 million per individual or 2316 million for married couples.

43804 Sunset Terrace Ashburn VA 20147 is a 4 bed 4 bath 1872 sqft townhouse now for sale at 499000. The federal estate tax currently taxes estates with net assets of 5250000 or greater. For instance a married.

The 2022 exemption is 1206 million up from 117 million in 2021. Of the exemption is estimated to cost 334 million. Recall that the current doubled.

In 2025 you both. In general the Gift Tax and Estate Tax provisions apply a unified rate schedule to a persons cumulative taxable gifts and taxable estate to arrive at a net tentative tax. Under the current tax law the higher estate and gift tax exemption will Sunset on December 31 2025.

The 2017 tax law commonly referred to as the Tax Cuts and Jobs Act Pub. If you have any questions on your Real Estate Tax please contact our office at 703-753-2600. Be advised that the.

Under current law the estate and gift tax exemption is 117 million per person. 115-97 TCJA amended the basic exclusion amount. Starting January 1 2026 the exemption will return to 549 million.

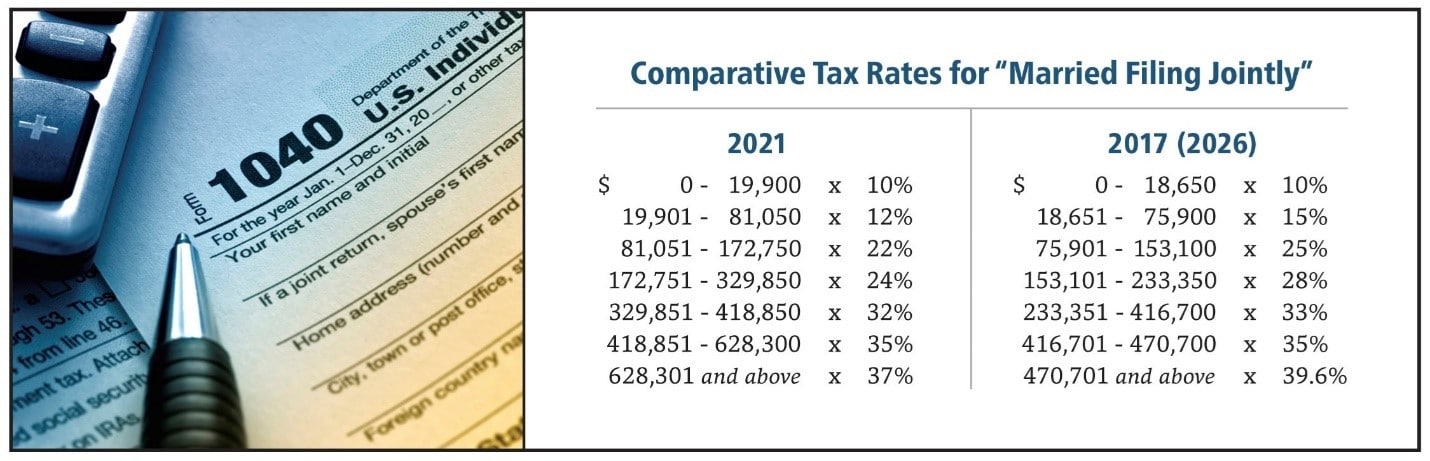

The credit to be applied for purposes of computing As estate tax is based on the 68 million basic exclusion amount as of As date of death subject to the limitation of section. Reduce tax bracket amounts. The current estate and gift tax exemption is scheduled to end on the last day of 2025.

The best courses of action for Sally Supper and Bob Banquet depend both upon tax rates and the current unified gift and estate tax exemption. The 2020 Real Estate Tax Rate is 129100 of assessed value. This gives most families plenty of estate planning leeway.

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

Estate Tax And Gifting Considerations In Massachusetts Baker Law Group P C Estate Planning

Idaho State 2022 Taxes Forbes Advisor

Charitable Giving Incentives Plus Switcher Credit Tuscon Phoenix Az

A New Severance Tax Incentive Emerges For Inactive Wells Sb533 Ke Andrews

Filing An Arizona State Tax Return Credit Karma Tax

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

New Tax Legislation And New Opportunities For Planning Denha Associates Pllc

Tax Tips For Military Personnel With Income From Rental Properties Article The United States Army

As The Tax Law Sunset Nears Review Savvy Gifting Solutions

Tax For Expats Claiming Dependents On Your Us Tax Return

Start Planning Now For A Higher Tax Environment Pay Taxes Later

What Will Happen When The Gift And Estate Tax Exemption Gets Cut In Half

Federal Estate And Gift Tax Exemption To Sunset In 2025 Are You Ready Adviceperiod

Don T Forget To Factor 2022 Cost Of Living Adjustments Into Your Year End Tax Planning

Burning Sunset Saguaro National Park Arizona Law Offices Of David L Silverman

Qtip Trust Will My Spouse Get What They Need Wilson Law Group Llc