property tax liens nj

Ad Compare New Jersey foreclosed homes by neighborhood schools size more. All Docketed Tax Court Cases.

Property Tax How To Calculate Local Considerations

Register for 1 to See All Listings Online.

. All municipalities in New Jersey are required by statute to hold annual sales of unpaid real estate taxes. See Prior Ownership History Sales Records Property Deed So Much More. The up to 35000 payment would come in the form of a three-year forgivable loan which would be listed as a lien on the property with no interest or payments due.

Search Any Address 2. BIDDING DOWN TAX LIENS Bidding for tax liens under the New Jersey Tax follows a procedure known as bidding down the lien. HUD Homes USA Is the Fastest Growing Most Secure Provider of Foreclosure Listings.

The New Jersey Estate Tax is a lien on all property of a decedent as of their date of death. February 1 May 1 August 1 and November 1. Find the best deals on the market in Hamilton NJ and buy a property up to 50 percent below market value.

Search Any Address 2. In fact the rate of return on property tax liens. Sheriff Jail and Sheriff Sales.

Buy Delinquent Tax Homes and Save Up to 50. Auction starts at 18 and interest rate can be bid down to zero then premium bidding begins. In New Jersey property taxes are a continuous lien on the real estate.

Ad Find Foreclosure Fortunes - Access Our Database Of Foreclosures Short Sales More. Find New Jersey Property Records. Up to 25 cash back In New Jersey the length of the redemption period depends on whether a third party bought the lien at the sale and whether the home is vacant.

The codicil specificallyy stated who owned what property. Up to 25 cash back A lien effectively makes the property act as collateral for the debt. Ad Free Course Teaches How To Find Invest Buy Tax Lien Homes In Your Area.

A municipality in New Jersey is required to sell delinquent property taxes once every es to hold tax sales of delinquent property taxes at least once a yearA tax lien purchase. Property taxes are due in four installments during the year. These lists contain the Tax Court local property tax cases docketed as of the date on the report.

By selling off these tax liens municipalities generate revenue. Search Bank Foreclosures Auctions Short Sales REOs Pre-Foreclosures and Tax Sales. They are sorted by county and then by docket number.

Selling your house to a direct buyer is one of the best ways to stop the frustrations that arise from tax liens. Hamilton NJ tax liens available in NJ. Comprehensive listings of foreclosures short sales auction homes land bank deals.

Find the best deals on the market in New Jersey and buy a property up to 50 percent below market value. Bidding down interest rate plus a. There are currently 156366 red-hot tax lien listings in New Jersey.

NJ tax liens pay 18 on liens over 1500. The lien attaches to real property for example a home or land and personal property for example a piece of jewelry you may own at the time the lien is filed. Search Atlantic County inmate records through Vinelink by offender id or name.

A New Jersey Property Records Search locates real estate documents related to property in NJ. Shop around and act fast on a new real estate. Tax Lien Certificates Sec.

Ad Find Tax Lien Property Under Market Value in New Jersey. The tax applies to all decedents who died after December 31 2001 but before January 1 2018. Ad Find Out the Market Value of Any Property and Past Sale Prices.

Now heirs own those homes separately codicil states they must pay their taxes and upkeep their own properties. If you need a Release or Subordination of Tax Lien for refinance or foreclosure of real estate. Ad Search Information On Liens Possible Owners Location Estimated Value Comps More.

In New Jersey county treasurers and tax collectors sell tax lien certificates to the winning bidder at the delinquent property tax sale. All states have laws that allow the local government to sell a home through a tax sale process to. According to New Jersey Law on tax lien certificate greater than 200 a penalty of 2 is added to the tax lien certificate tax lien certificates greater than 5000 bring a 4 penalty and tax.

Ad Find Foreclosure Fortunes - Access Our Database Of Foreclosures Short Sales More. New Jersey tax liens available in NJ. Public Property Records provide information on land.

See Available Property Records Liens Owner Info More. Tax liens are most often placed on homes and it applies to the equity on the property. A tax lien cannot be removed by a bankruptcy filing but a debtors liability to pay the tax may be released.

See Available Property Records Liens Owner Info More. Ad Search Information On Liens Possible Owners Location Estimated Value Comps More. Atlantic County Sheriff and Jail.

Are you ready to sell a New Jersey house. These tax foreclosed homes are available for pennies on the dollar - as much as 75 percent off full market price and more. Since the amount that the bidder must pay for the lien is fixed.

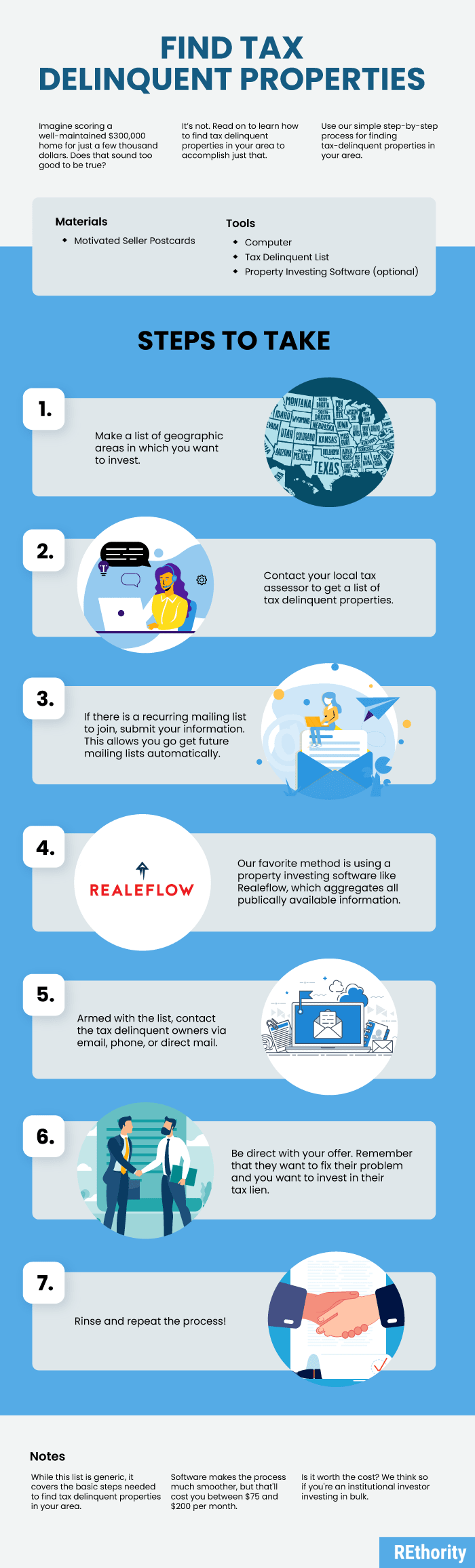

How To Find Tax Delinquent Properties In Your Area Rethority

Mapsontheweb Infographic Map Map Sales Tax

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

The Ten Lowest Property Tax Towns In Nj

Will You Get A Break On Your N J Property Taxes During Coronavirus Crisis Nj Com

The United States Of Sales Tax In One Map Map States Federal Taxes

Real Estate Investing 101 Tax Lien Vs Tax Deed Investing Call Today 800 617 6251 Http Www Sportfoy Com Real Estate Inv Real Estate Nj Real Estate Real

How To Find Tax Delinquent Properties In Your Area Rethority

Freehold Township Sample Tax Bill And Explanation

Best Kept Secret Insight To Tax Lien And Tax Deed Investing Nook Book Investing Best Kept Secret Insight

These 7 U S States Have No Income Tax The Motley Fool Income Tax Map Amazing Maps

Freehold Township Sample Tax Bill And Explanation

Unfair And Unpaid A Property Tax Money Machine Crushes Families Wealth Management

If You Wish To Invest In Tax Lien Properties The State Of New Jersey Conduct Online Tax Sales Online Taxes Bid Tax

How Much Do You Need To Make To Buy A Home In Barnegat Home Buying Real Estate Education States